Alignment PLatinum (HMO-POS)

Benefit Highlights

- $0 Monthly Premium

- $0 Medical Deductible

- $0 Primary Doctor Copay

- $3 In-Network Specialist $10 Out-of-Network Specialist

- $2,900 Medical Maximum Out-of-Pocket Limit.

- Coverage for Hospitalization, Doctors, Prescription Drugs, Hearing, Dental, Vision, and More!

Online tools

Use the buttons below to be taken to the Alignment Health Member Services Portal, search for a Provider in your plan's network, or find a Prescription Drug on the Alignment Formulary.

Plan Summary of benefits

Click the buttons below to view the Platinum Plan's Summary of Benefits and Evidence of Coverage

Referrals (seeing a specialist)

- You have a network primary care provider (a PCP) who is providing and overseeing your care. As a member of our plan, you must choose a network PCP

- In most situations, your network PCP must give you approval in advance before you can use other providers in the plan’s network, such as specialists, hospitals, skilled nursing facilities, or home health care agencies. This is called giving you a referral .Referrals from your PCP are not required for emergency care or urgently needed services.

- If you need medical care that Medicare requires our plan to cover but there are no specialists in our network that provide this care, you can get this care from an out-of-network provider at the same cost sharing you normally pay in-network. Prior authorization is required before you get care from an out-of-network provider. In this situation, you will pay the same as you would pay if you got the care from a network provider.

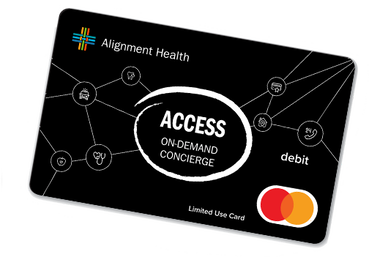

Flex Card detailsYour ACCESS On-Demand Concierge Black Card will be programmed to allow for purchases at Acupuncture, Chiropractic, Vision, Dental, Hearing, and Podiatry offices. There is no network restriction to use this benefit.

|

- Any unused dollars expire at the earlier of your plan termination date or end of the 2024 calendar year and do not carry over to the following year. You are responsible for all fees which exceed the benefit maximum.

- You will receive your allowance through your automatically loaded FLEX Allowance on your ACCESS On-Demand Concierge Black Card.

- If you enroll in or after July, you will receive $1,000.00 for the remainder of the calendar year.

- If you enroll within January - June, you will receive $1,000.00 for each six months enrolled.