Medicare Advantage Plans, also called Medicare Part C or “All in One Plans”

change their benefit details each year.

In September – you will receive an Annual Notice of Change detailing the plan benefits and details for the next year. We call this the ANOC letter. It may come from the insurance in an envelope which looks like other correspondence – so keep your eyes out for this.

|

What can change? MEDICAL BENEFITS

|

For Medicare Rx plans included in the plan - deductible and for which tiers of Rx, copays you pay for medications, and the list of covered prescriptions.

Note - These Medicare Rx plans work the same as Stand Alone Part D plans – please see link to Medicare Rx 2024 for details.

Note - These Medicare Rx plans work the same as Stand Alone Part D plans – please see link to Medicare Rx 2024 for details.

Also Doctors, specialists, medical facilities in-network and how a plan covers or does not cover providers out of network or out of service area or state.

Extra Value Benefits not covered by Original Medicare:

In short – any and all of plan benefits can change!

“Wow … this is big and pretty confusing... How can I determine if I should stay with same plan or consider changing?"

- Dental benefits, amount coverage, network of dentist or straight reimbursement

- Vision & hearing

- Transport, OTC – over the counter benefit

- Gym membership and to which facilities

- And Medicare Part B Giveback

In short – any and all of plan benefits can change!

“Wow … this is big and pretty confusing... How can I determine if I should stay with same plan or consider changing?"

We have a technique for that:

- Rx Medications - Let’s review your RX medications - any changes?

- Doctors - Who are your primary care doctors or any specialist you see on regular basis? Any new doctors?

- Health- Has your health changed, improved or has something new happened? Are you planning a procedure like knee surgery next year along with new doctors?

- The Extra Values

- Dental - a plan with larger benefit where your favorite dentist is in network

- Eyeglasses or contacts?

- Or you need a hearing aids? ( say what? )

- Gym membership – you would like to go the YMCA for the pool or a new exercise facility which just opened in your neighborhood

Review what is most important to you in a Medicare plan. Use our Medicare Discovery Tool and find your most beneficial plan

Start a list of this information. With this – we can review and find the most effective plan for YOU.

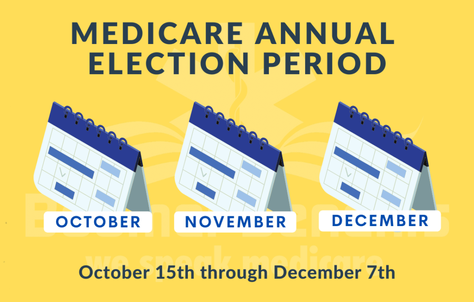

Calendar - When can I make Changes?

Annual Enrollment Period ( AEP) 10/15 – 12/07 - New plans are effective January 1.

And - New from last year – Expanded Open Enrollment Period –January 1 – March 31 - You may change a Medicare Advantage plan to another Medicare Advantage – but only once during this period.

Annual Enrollment Period ( AEP) 10/15 – 12/07 - New plans are effective January 1.

And - New from last year – Expanded Open Enrollment Period –January 1 – March 31 - You may change a Medicare Advantage plan to another Medicare Advantage – but only once during this period.

Our agents appreciate the opportunity to serve you,

Dave Trout

Jessica Cody

Jeremy Sheridan

David Hanson

Dave Trout

Jessica Cody

Jeremy Sheridan

David Hanson