The enrollment process can seem like a daunting task, but we’re here to help make the transition to Medicare as easy and assuring as possible. Most people enroll in Medicare for the first time around age 65 (earlier enrollment allowed for those with a qualifying disability or medical condition) and aren’t quite sure how to start the process of enrollment in “Original Medicare”. Below is a guide to get you started in finding the best possible Medicare plan for you or a loved one.

The enrollment process can seem like a daunting task, but we’re here to help make the transition to Medicare as easy and assuring as possible. Most people enroll in Medicare for the first time around age 65 (earlier enrollment allowed for those with a qualifying disability or medical condition) and aren’t quite sure how to start the process of enrollment in “Original Medicare”. Below is a guide to get you started in finding the best possible Medicare plan for you or a loved one.

Getting Started - Enrolling in Original Medicare

First Step - During your Initial Enrollment Period (3 months before, the month of, and the 3 months after turning age 65) you’re eligible to begin enrolling in Original Medicare. To start the process, you’ll need to contact the Social Security Administration to get signed up. Signing up can be done in-person, over the phone, and online.

Next Step -Congratulations! You’re now signed up for Original Medicare and you can start to look for additional Medicare options to best fit your needs. There are Medicare Advantage Plans (Part C), Medicare Advantage with Drug Coverage (MAPD), Medicare Supplement Plans, Prescription Drug Plans, and Special Needs Plans. You’ll need to look over your medical needs to make sure that you find a plan that best meets them. We’ll be happy to help review your information with you.

The information you will want to review:

* Primary Care Physician (Do they accept Medicare, are they in network, etc.)

* Specialist(s) you're seeing regularly

* The Prescription Drugs you're taking regularly

* Your Income (You may qualify for financial assistance)

* Primary Care Physician (Do they accept Medicare, are they in network, etc.)

* Specialist(s) you're seeing regularly

* The Prescription Drugs you're taking regularly

* Your Income (You may qualify for financial assistance)

More information about Medicare is available below.

- Check out our Frequently Asked Questions page.

- More information about Medicare Benefits.

- Fitness Programs for Seniors.

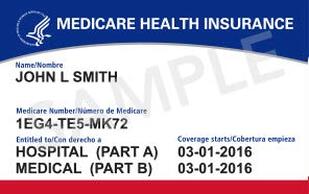

Original Medicare - Part A and Part B

Part A - Part A is referred to as “Hospital Insurance Benefits.” Part A also covers other inpatient care, including skilled nursing facilities, rehabilitation facilities, hospice care, and home health services. Most individuals (age 65 or older) are entitled to Part A without paying a premium, if you or your spouse have worked and paid Medicare taxes for at least 10 years. Individuals with a qualifying disability or medical condition are also eligible for premium-free Part A.

Part B - Part B is referred to as “Supplementary Medical Insurance Benefits.” Part B covers a broad range of outpatient services such as physician care, and drugs that are administered by physicians or other health care professionals (such as vaccines and intravenous medications). Clinical Lab services, durable medical equipment, preventive services, and other outpatient medical services are also covered under Part B. Some people are automatically enrolled in Part B, but the choice to enroll in B is optional. Choosing not to enroll in Part B during your Initial Enrollment Period (3 months before, the month of, and the 3 months after turning age 65) can result in a “Late Enrollment Penalty”, which is applied to your monthly premium. Part B premiums can be paid through Social Security withdrawals or by monthly payment. **Monthly Premium Amount Depends on Income**