Save up to $1,800 annually with Part B GiveBack.

There are Health Insurance plans who will now put money back onto your Social Security retirement benefit.

NEW PLANS all across the state with More Options than Ever Before. Including folks living in Buncombe, Henderson, Madison & Transylvania counties.

These plans include Medical and Prescription coverage. Plus Dental, Vision, Hearing, Over the Counter Allowance and More.

Sign Up before Dec 7, 2023 and receive up to $150 monthly in Part B Give Back. That’s as much as $1,800 every year!

|

|

"This is the real deal. Last year, excited to discover we could get money back on our social security benefit. We saved $2,400 in 2023. Call Dave or David"

- Debra & Joe R. Contact Dave or David at Trout Insurance

|

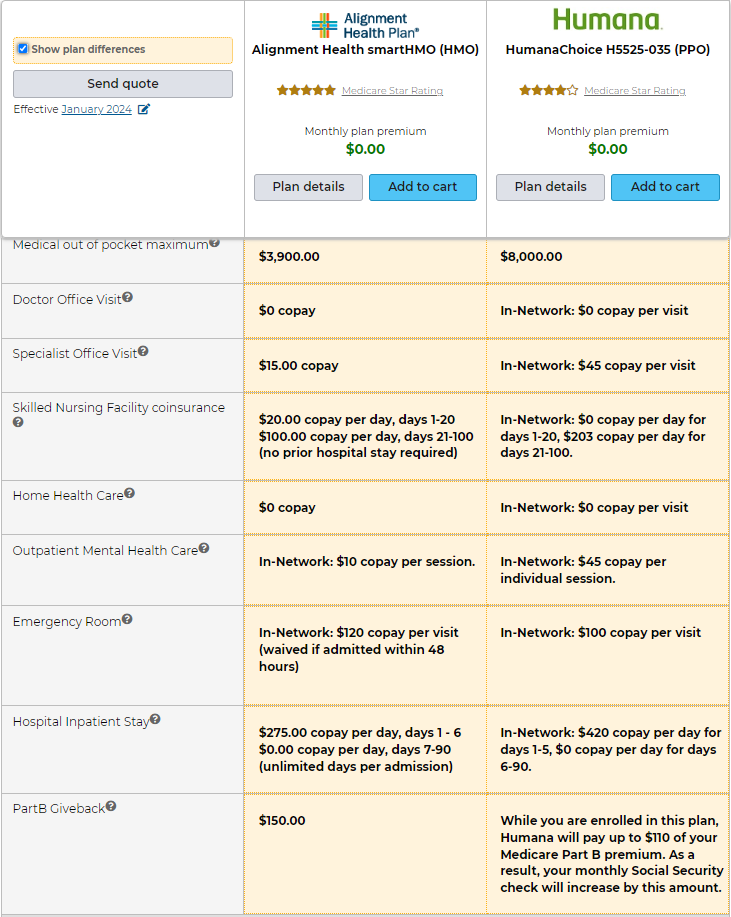

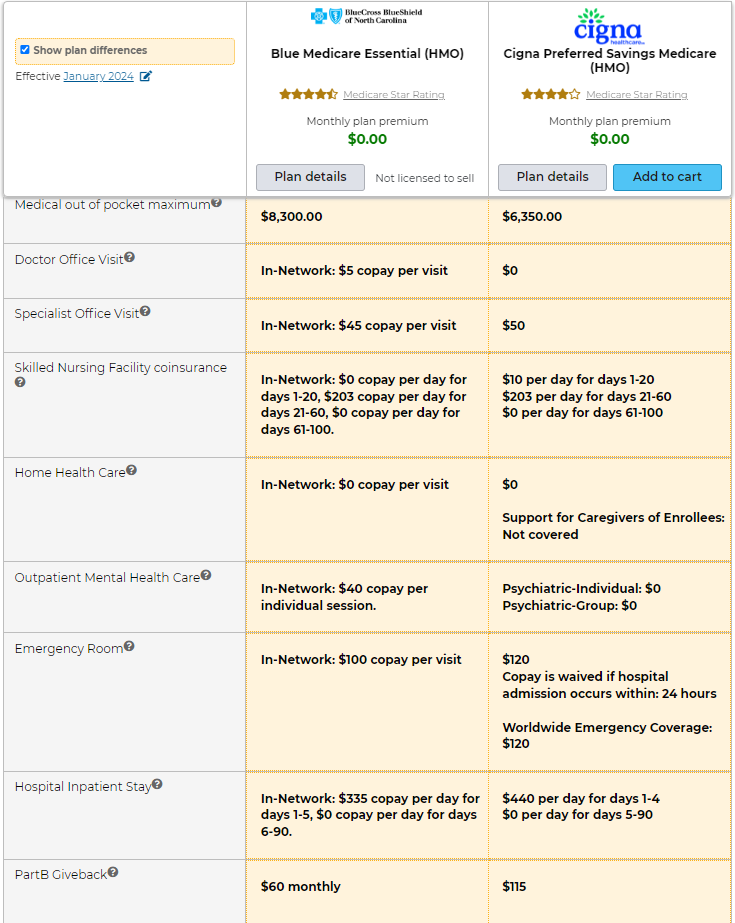

Examples of Part B GiveBack

The Details: Medicare Part B Premium Reduction

Your Medicare Part B premium is automatically deducted from your monthly Social Security check. While you are enrolled in a “Part B Give Back” plan, the insurance company will pay up to their specified reduction amount of your Medicare Part B premium. As a result, your monthly Social Security check will increase by this amount. You do not have to complete any paperwork to receive this benefit. We will take care of that for you.

The portion of your Medicare Part B premium the company pays only applies to any amount not paid by Medicaid. It could take several months for the Social Security Administration to complete their processing. This means you may not see the increase in your Social Security check for several months after the effective date of this plan. Any missed increases will be added to your next check after processing is complete.

Please note that if you dis-enroll from this plan, your Medicare Part B premium benefit will end on the date of dis-enrollment. As mentioned above, it could take several months for the Social Security Administration to complete their processing. Any premium reductions you receive after you dis-enroll will eventually be deducted from your Social Security check. You must continue paying your Medicare premiums to remain a member of the plan. This includes your premium for Part B. It may also include a premium for Part A which affects members who aren’t eligible for premium free Part A.

Your Medicare Part B premium is automatically deducted from your monthly Social Security check. While you are enrolled in a “Part B Give Back” plan, the insurance company will pay up to their specified reduction amount of your Medicare Part B premium. As a result, your monthly Social Security check will increase by this amount. You do not have to complete any paperwork to receive this benefit. We will take care of that for you.

The portion of your Medicare Part B premium the company pays only applies to any amount not paid by Medicaid. It could take several months for the Social Security Administration to complete their processing. This means you may not see the increase in your Social Security check for several months after the effective date of this plan. Any missed increases will be added to your next check after processing is complete.

Please note that if you dis-enroll from this plan, your Medicare Part B premium benefit will end on the date of dis-enrollment. As mentioned above, it could take several months for the Social Security Administration to complete their processing. Any premium reductions you receive after you dis-enroll will eventually be deducted from your Social Security check. You must continue paying your Medicare premiums to remain a member of the plan. This includes your premium for Part B. It may also include a premium for Part A which affects members who aren’t eligible for premium free Part A.

Plans Include HMO, HMO POS,HMO C-SPN, HMO D-SNP and PPO with a Medicare & Medicaid contract in North Carolina. Premium and benefit availability varies by plan.