Medicare Part D Premiums to Dip Slightly in 2024

CMS projects average monthly prescription drug charge to fall by nearly $1

The average monthly premium for Medicare Part D prescription drug coverage is expected to fall slightly in 2024, to $55.50, a 99-cent drop from the 2023 average of $56.49, the Centers for Medicare & Medicaid Services (CMS) announced on July 31.

The amount beneficiaries will pay in 2024 will vary depending on which prescription drugs they take, what plan they pick and where they live. In addition to premiums, deductibles and copays also vary by plan. CMS says more than 51 million Medicare beneficiaries currently have prescription drug coverage.

More information about the Part D Premium decrease can be found at AARP.org

Learn more about your Medicare options at MedicareOptionsForYou.com

The amount beneficiaries will pay in 2024 will vary depending on which prescription drugs they take, what plan they pick and where they live. In addition to premiums, deductibles and copays also vary by plan. CMS says more than 51 million Medicare beneficiaries currently have prescription drug coverage.

More information about the Part D Premium decrease can be found at AARP.org

Learn more about your Medicare options at MedicareOptionsForYou.com

Should you enroll in Medicare if you're 65 and still working?

A growing number of Americans are working past age 65—typically the age when you enroll in Medicare. But if you’re still getting health insurance through your employer at that age, does it make sense to move to Medicare?

The best answer to that question depends on factors unique to you, including:

When navigating the question “When should I enroll in Medicare?” it’s important to step carefully in order to avoid stiff late enrollment penalties for Medicare Part B (outpatient services) and smaller penalties for Part D (prescription drugs).

Let’s walk through the rules on timing your Medicare enrollment, and the tradeoffs of these decisions.

More information found here at Morningstar.com

The best answer to that question depends on factors unique to you, including:

- The features and cost of your current insurance.

- The size of your employer’s firm and your income.

- Your health.

- How you want to receive healthcare.

When navigating the question “When should I enroll in Medicare?” it’s important to step carefully in order to avoid stiff late enrollment penalties for Medicare Part B (outpatient services) and smaller penalties for Part D (prescription drugs).

Let’s walk through the rules on timing your Medicare enrollment, and the tradeoffs of these decisions.

More information found here at Morningstar.com

New Bill Creates More Savings for Part D Beneficiaries

Insulin Costs for Medicare Patients Capped at $35 Per Month

On Tuesday, August 16th 2022, President Joe Biden signed a new legislative package named the Inflation Reduction Act. Beginning in 2023, the bill will limit insulin copays to $35 per month for Medicare Part D beneficiaries. Also included in the act, Medicare Part D Beneficiaries will have a $2000 annual out-of-pocket cap on prescription drugs starting in 2025.

On Tuesday, August 16th 2022, President Joe Biden signed a new legislative package named the Inflation Reduction Act. Beginning in 2023, the bill will limit insulin copays to $35 per month for Medicare Part D beneficiaries. Also included in the act, Medicare Part D Beneficiaries will have a $2000 annual out-of-pocket cap on prescription drugs starting in 2025.

What Medicare Beneficiaries on Insulin Can Expect

Beginning in 2023, Medicare beneficiaries will have their insulin costs capped at $35 per month, which included those who use insulin pumps. Beneficiaries who pay more than $35 per month after the bill is initially enacted will be reimbursed, according to the American diabetes Association. “We’re very excited that seniors are going to see these cost savings” said Dr. Robert Gabbay, chief scientific and medical officer at the American Diabetes Association.

Beginning in 2023, Medicare beneficiaries will have their insulin costs capped at $35 per month, which included those who use insulin pumps. Beneficiaries who pay more than $35 per month after the bill is initially enacted will be reimbursed, according to the American diabetes Association. “We’re very excited that seniors are going to see these cost savings” said Dr. Robert Gabbay, chief scientific and medical officer at the American Diabetes Association.

New Medicare Benefits for People with Chronic Conditions

- Insulin Savings Programs Expansion: 3.3 million beneficiaries use one of more types of insulin, according to the Centers for Medicare and Medicare Services. More than 2,100 Part D and Medicare Advantage plans will participate in the 2022 program, an increase of over 500.

- Extra Benefits for Medicare Advantage Enrollees: Some Medicare Advantage Plans offer extra health-related benefits including: coverage of Over-the-Counter medications, in-home support services, meal delivery, pest control, and more.

- Special Needs Plans offer extras: A type of Medicare Advantage Plan called Special Needs Plan (SNP) provides coverage for certain groups of people. These plans must provide prescription drug coverage, and they usually offer extra benefits, such as lower copayments for specialists and medications.

For a more detailed breakdown of the information below, click here

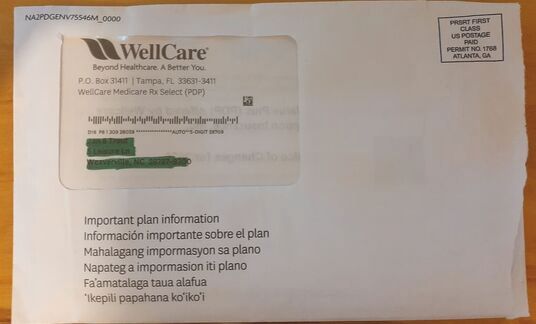

How To Read Your Annual Notice of Change

Each year, your Medicare Advantage and Medicare RX plans will change and update their benefits for the upcoming year.

For Medicare RX plans – these include

Premiums, Rx deductibles and copays, and Rx tier details

Look for a thick envelope like this...

For Medicare RX plans – these include

Premiums, Rx deductibles and copays, and Rx tier details

Look for a thick envelope like this...

BE SURE TO OPEN IT!

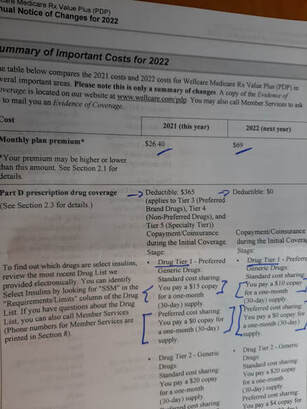

And Then - Look for "Summary of Important Costs for 2022"

And Then - Look for "Summary of Important Costs for 2022"

This will highlite Changes for 2022 in your current plan.

What’s Next ??

We’ll be sending you email with how we can help you. Especially reviewing your Prescriptions and how they will be best covered for 2022. We have new tools and software.

Please see

http://www.medicareoptionsforyou.com/medicare-2022-rx-plans.html

http://www.medicareoptionsforyou.com/medicare-center-software.html

AND – For Medicare Advantage plans

http://www.medicareoptionsforyou.com/medicare-advantage-plans-2022.html

What’s Next ??

We’ll be sending you email with how we can help you. Especially reviewing your Prescriptions and how they will be best covered for 2022. We have new tools and software.

Please see

http://www.medicareoptionsforyou.com/medicare-2022-rx-plans.html

http://www.medicareoptionsforyou.com/medicare-center-software.html

AND – For Medicare Advantage plans

http://www.medicareoptionsforyou.com/medicare-advantage-plans-2022.html

2021 Medicare Part B Premiums Remain Steady

In short: Medicare Part B Premium = $148.50 and Medicare Part B Deductible = $203

Medicare Part B premiums remain steady and seniors have more plans than ever to choose from, many new benefits, and historically low Medicare Advantage and Part D premiums.

The Centers for Medicare & Medicaid Services (CMS) announced the 2021 monthly Medicare Parts A and B premiums, deductibles, and coinsurance amounts for Medicare Part B premiums will remain steady. Medicare Open Enrollment started on October 15, 2020 and runs through December 7, 2020- making now the time to review your plan and benefits. Medicare Advantage (or private Medicare health plans) and Part D prescription drug plan premiums are at historic lows, with hundreds of Medicare Advantage and Part D plans now offering $35 monthly co-pays for insulin starting in January 2021.

Call on our experienced agents today to review your coverage! 828.279.4681

More details available at CMS.gov

Medicare Part B premiums remain steady and seniors have more plans than ever to choose from, many new benefits, and historically low Medicare Advantage and Part D premiums.

The Centers for Medicare & Medicaid Services (CMS) announced the 2021 monthly Medicare Parts A and B premiums, deductibles, and coinsurance amounts for Medicare Part B premiums will remain steady. Medicare Open Enrollment started on October 15, 2020 and runs through December 7, 2020- making now the time to review your plan and benefits. Medicare Advantage (or private Medicare health plans) and Part D prescription drug plan premiums are at historic lows, with hundreds of Medicare Advantage and Part D plans now offering $35 monthly co-pays for insulin starting in January 2021.

Call on our experienced agents today to review your coverage! 828.279.4681

More details available at CMS.gov

September 25, 2020

Medicare Plan Annual Notice of Change: What to Look For

Highlights: For Our Medicare Clients with Stand Alone Medicare RX plans or Medicare Advantage plans.

For help - Call your Trout Insurance Agent. Main line: 828.279.4681

- Look for your ANOC (Annual Notice of Change) by Sept 30

- Review your medications - Has anything changed during 2020? Have you added a new expensive brand name RX? If so - let us know.

- Only take a couple of low cost generics? - New lower premium options for 2021.

- Have your doctors changed? Or have you changed address to a different county? If so - you may need to change your plan.

- Many Companies offer Extra Value Benefits - Gym membership, Vision, Dental, Hearing Aids and More

For help - Call your Trout Insurance Agent. Main line: 828.279.4681

Over the next few months, you’re probably going to receive a lot of information about Medicare. It’s all meant to help you understand your coverage choices and make informed decisions during the Medicare Annual Enrollment Period (Oct. 15 – Dec. 7). There is one piece of Medicare mail, though, that you want to be sure to read. It’s called the Annual Notice of Change, or ANOC for short, and it comes from your current Medicare plan provider. Delivered by September 30, ANOC letters ensure that plan members have up-to-date plan information before the Medicare Annual Enrollment Period begins.

Your Medicare Advantage or Medicare Part D prescription drug plan ANOC provides important information. It can help you decide whether to keep your current plan or look for a new one during the Annual Enrollment Period. Here’s what to look for when you get your ANOC, along with questions to help you understand plan changes and what they may mean for you.

Coverage changes:

Provider network changes:

Drug list and pharmacy network changes:

Cost changes:

Check with your plan if you are unclear about anything in the ANOC or if you did not receive an ANOC letter. You can call the customer service number on the back of your member card. Your Medicare plan details may change every year.

Medicare Advantage plans and Medicare prescription drug plans are offered by private insurance companies under contract with Medicare. Each year, they review their plan details each year and make changes as needed to better serve plan members. Take time to Review your Plan. You don’t want to be caught off guard by higher costs or coverage changes after January 1. And whatever your decision may be—to stay with your current plan or to explore other Medicare coverage options—you want to make it based on the facts.

Your Medicare Advantage or Medicare Part D prescription drug plan ANOC provides important information. It can help you decide whether to keep your current plan or look for a new one during the Annual Enrollment Period. Here’s what to look for when you get your ANOC, along with questions to help you understand plan changes and what they may mean for you.

Coverage changes:

- What new benefits have been added to your plan?

- Are there other changes that affect services you use?

- Have there been any changes in your health that may affect what services you may need or how often you may need them?

- If your health has changed, will your plan benefits cover the additional care you may need?

Provider network changes:

- What providers have been added to or removed from the plan network?

- Are your current doctors in the network?

- What about hospitals or other providers or specialists you may need?

- If your providers are not in the network, are you willing to switch to other providers that are?

Drug list and pharmacy network changes:

- What medications have been added to or removed from the plan’s covered drug list (formulary)?

- Are the drugs you currently take listed on the formulary?

- Have any of your medications been assigned to a different tier on the formulary? (This may affect your cost.)

- Is your pharmacy in the plan’s network? Is it a “preferred pharmacy” that offers the plan’s best pricing?

Cost changes:

- Is the plan premium going up, going down or staying the same?

- Are any other costs changing, such as deductibles, co-pays, co-insurance?

- If you have a Medicare Advantage plan, what is your maximum out-of-pocket limit?

- How will cost changes affect your total out-of-pocket spending for the services and prescription drugs you may need?

Check with your plan if you are unclear about anything in the ANOC or if you did not receive an ANOC letter. You can call the customer service number on the back of your member card. Your Medicare plan details may change every year.

Medicare Advantage plans and Medicare prescription drug plans are offered by private insurance companies under contract with Medicare. Each year, they review their plan details each year and make changes as needed to better serve plan members. Take time to Review your Plan. You don’t want to be caught off guard by higher costs or coverage changes after January 1. And whatever your decision may be—to stay with your current plan or to explore other Medicare coverage options—you want to make it based on the facts.

Did You Know There are Three Types of Comprehensive Wellness Visits Available to Medicare Beneficiaries?

- Within the first 12 months of enrolling into the Medicare Part B plan the “Welcome to Medicare” Preventive Visit coverage is available. Usually conducted by your PCP (Primary Care Physician), this free visit includes a broad review of your health and offers counseling and education about different prevention methods that may be helpful and needed.

- Another Medicare covered benefit is annual wellness visits, this is available to everyone who enrolls in Medicare Plan B. This is offered every year, however, the annual wellness is a conversation between you and the doctor to review your medical history, medications, immunizations, and discuss any health concerns in the foreseeable future.

- Annual routine physicals are not covered by Medicare, however, it may offer free of charge to many members of Medicare Advantage Plans once every calendar year. It included a broad examination that includes medical history review and may include other examinations.

Nov. 26, 2019

Medicare Part B premium & Deductible - 2020

2020 Medicare Parts A & B Premiums and Deductibles

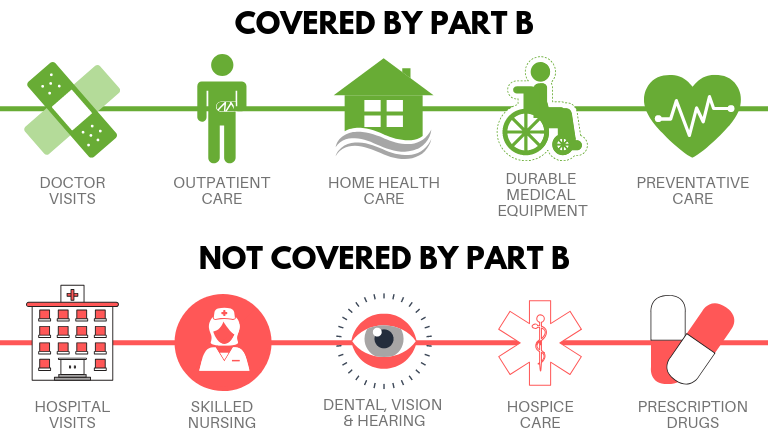

On November 8, 2019, the Centers for Medicare & Medicaid Services (CMS) released the 2020 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Medicare Part B Premiums/Deductibles

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

On November 8, 2019, the Centers for Medicare & Medicaid Services (CMS) released the 2020 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Medicare Part B Premiums/Deductibles

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

SEP 12, 2019

Medicare Annual Enrollment Period- Window Shop Oct 1

For those of you who are on Medicare, Annual Enrollment for Medicare Advantage and Part D Rx plans will be available soon. Starting October 1st – we can preview plans for 2020. We will be able to help you determine the best plan to meet your needs for the upcoming year. And even though AEP does not effect Supplemental plans, this is a good time to review these as well.

To get started: http://www.medicareoptionsforyou.com/enroll-for-2020.html

To get started: http://www.medicareoptionsforyou.com/enroll-for-2020.html

AUG 30, 2019

Become an Informed Medicare Consumer

As a Medicare consumer did you know that you have rights and protections under law? Being a Medicare consumer, it is very important to stay up to date and informed about what is happening when it comes to your Medicare. Make sure you get the health care services that the law says you can get. Not only is being informed important, but also keeping everything safe is very important.

Identity theft is not just something you see in the movies, but it is a real thing and should be avoided at all costs, by keeping your Social Security Number, bank account numbers and Medicare Number safe. If anything ever happens regarding fraud, know how to report it. Get involved with the Senior Medicare Patrol (SMP), who educate and empower Medicare users with how to take an active role in preventing fraud.

For more information on how to become a more informed Medicare Consumer contact a Trout Insurance agent today and let them help you know more about Medicare.

Identity theft is not just something you see in the movies, but it is a real thing and should be avoided at all costs, by keeping your Social Security Number, bank account numbers and Medicare Number safe. If anything ever happens regarding fraud, know how to report it. Get involved with the Senior Medicare Patrol (SMP), who educate and empower Medicare users with how to take an active role in preventing fraud.

For more information on how to become a more informed Medicare Consumer contact a Trout Insurance agent today and let them help you know more about Medicare.

JULY 22, 2019

3 tips for people in the Qualified Medicare Beneficiary Program

Qualified Medicare Beneficiary Program is a program that was set up by the state and Federal Government, that is in place to help low income individuals share their costs of Medical and drug costs. If you are on this QMB program, Medicare providers are not allowed to bill you for services and items that Medicare covers such as deductibles, copayments and coinsurance. It is against the law. If you are ever billed for any of these, here are three tips of what you should do in that situation:

- Show your provider your Medicare and Medicaid or QMB card or inform them that you are in the program. By this you cannot be charged for Medicare deductibles, copayments and coinsurance.

- If your provider will not stop Billing, you call 1-800-MEDICARE

- If you have a problem with your debt collector, you can send a complaint to Consumer Financial Protection Bureau (CFPB) online or call.

June 20, 2019

Medicare Card Replacement

A Medicare card is very important and should always be kept safe, but sometimes life just does not work like that. It can get lost or damaged and the question then is, what to do now? We have some good news for you. Replacing your Medicare in 2019 is not very difficult, in addition to this, the old Medicare cards are being replaced with new ones that will not include your social security number.

Before you can even lose the card, try by all means to keep a copy of the original one in the event that it does go missing. Getting the card replaced online is the best option, all you need to do is to go to the Social Security Website and create a “My Social Security” account. Once you have logged I, visit the documents tab. You will find an option that asks them to mail you a replacement card where the sight will ask you for your credentials. The card may take about 30 days to replace.

For any more information about this process call a Trout Insurance Agent today.

Before you can even lose the card, try by all means to keep a copy of the original one in the event that it does go missing. Getting the card replaced online is the best option, all you need to do is to go to the Social Security Website and create a “My Social Security” account. Once you have logged I, visit the documents tab. You will find an option that asks them to mail you a replacement card where the sight will ask you for your credentials. The card may take about 30 days to replace.

For any more information about this process call a Trout Insurance Agent today.

May 13, 2019

You Shouldn’t Wait to Sign Up for Medicare Part B – Here’s Why

George Zeppenfeldt-Cestero was a 68-year-old man who paid a great private insurance plan with AETNA. He paid his premiums with AETNA for 3 years after his 65 th birthday when AETNA notified him that they had to discontinue his private plan. Only then did he realize that he was meant to be on Medicare for the past 3 years. Both Medicare and his Insurance company did not notify him about this and now he must face a penalty for the rest of his life (as long as he has Medicare). The Penalty that he has to face is that George will have to Enroll for Medicare in the GEP (General Enrollment Period), which occurs yearly from January 1 st - March 31 st and your coverage does not begin until July of that year, so there can be significant delays. The other penalty George will have to face is that he will have to pay an additional 10% tacked on to his monthly premium for every year he did not have creditable coverage but was eligible for Medicare.

To avoid being like George, call a Trout Insurance agent today and avoid lifelong penalties.

To avoid being like George, call a Trout Insurance agent today and avoid lifelong penalties.

April 17, 2019

What's the difference between Medicare HMO & Medicare PPO Plans?

HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) are 2 forms of Medicare Advantage plans.

Differences

In general, the PPO offers more choice than the HMO plan. In the HMO plans, you need to choose a primary care provider, whereas in a PPO, members are free to choose any provider they

wish to. HMO plans cover for healthcare provided in the network, and similarly with the PPO plans but you will have to pay a higher price for out of network providers.

Similarities

Both HMO and PPO plans include drug coverage and emergency care for any provider. Both HMO and PPO plans combine hospital and medical insurance in a single plan. Both plans have a

network of contracted doctors and hospitals.

These are the basics of the differences between HMO and PPO plans.

To find out more about these plans, contact a Trout Insurance agent to help you choose the best Medicare advantage

plan.

Differences

In general, the PPO offers more choice than the HMO plan. In the HMO plans, you need to choose a primary care provider, whereas in a PPO, members are free to choose any provider they

wish to. HMO plans cover for healthcare provided in the network, and similarly with the PPO plans but you will have to pay a higher price for out of network providers.

Similarities

Both HMO and PPO plans include drug coverage and emergency care for any provider. Both HMO and PPO plans combine hospital and medical insurance in a single plan. Both plans have a

network of contracted doctors and hospitals.

These are the basics of the differences between HMO and PPO plans.

To find out more about these plans, contact a Trout Insurance agent to help you choose the best Medicare advantage

plan.

October 18, 2018

What you need to know for Medicare Enrollment

If you’re approaching the age of 65, in addition to considering life without an alarm clock, you need to consider your health insurance options very carefully. A form of Medicare most likely will be your main health insurance.

Because there are so many options, it can be complicated. I’ll break the basics down and share some resources to help you make the right decision.

Don’t wait to think about your options! When you turn 64, here is a great month by month checklist of things to consider.

THE BASICS

THE OPTIONS

MEDICARE PART A AND B PLANS (ORIGINAL MEDICARE)This is what we call original Medicare which the government administers. The premium is deducted from your monthly social security check.

Original Medicare does not cover most prescription drugs or other services private insurers may offer.

MEDICARE SUPPLEMENT (MEDIGAP)A Medicare Supplement (Medigap) policy is an additional option when purchasing Original Medicare. It’s sold by private insurers and helps pay some or all the health care costs that Medicare doesn’t cover, like copayments. coinsurance. deductibles.

MEDICARE ADVANTAGE PART C PLANSThis type of plan is administered by a private health insurer. These plans, in addition to offering everything Original Medicare provides, offer additional features and benefits that you may not get with a Medicare Supplement plan.Most of these plans include prescription drug coverage and have in-network doctors. You would pay your premium directly to a private insurer and maintain lower out of pocket costs if seeing network doctors.

When selecting a Medicare Advantage Plan you would still be required to pay your Medicare Part B premium, normally deducted from your social security check.

MEDICARE PART D (PRESCRIPTION DRUG COVERAGE)This type of plan is administered by a private health insurer. Medicare Part D is a standalone prescription plan that helps cover your prescription needs and is typically paired with a Medicare Supplement plan. Many Medicare Advantage plans have Part D drug coverage, but there are some that offer medical benefits only. You are not allowed to have both a Medicare Advantage plan and a stand-alone Part D drug plan.

Because there are so many options, it can be complicated. I’ll break the basics down and share some resources to help you make the right decision.

Don’t wait to think about your options! When you turn 64, here is a great month by month checklist of things to consider.

THE BASICS

- Medicare is a federal insurance program. To qualify you must be 65+, under 65 with a disability or have an end-stage renal disease.

- According to Medicare.gov, if you don’t enroll when first eligible you may pay a penalty and have a gap in coverage. An exception to this is if you have other credible coverage like a health insurance plan from your employer.

- You can keep Original Medicare only (the Federal program) and in addition, you may purchase a Medicare Supplement plan to help with the copays and deductibles that Original Medicare does not cover.

- You can replace Original Medicare with a Medicare Advantage plan (from a private insurer who has a Medicare contract to administer benefits). Many do this because of the additional options they offer.

- This year’s open enrollment to purchase a Medicare Advantage or Part D plan (prescription drug coverage) is Oct. 15 – Dec. 7.

THE OPTIONS

MEDICARE PART A AND B PLANS (ORIGINAL MEDICARE)This is what we call original Medicare which the government administers. The premium is deducted from your monthly social security check.

- Medicare Part A covers inpatient hospital stays, skilled nursing facilities, hospice care, and some home health care.

- Medicare Part B covers certain doctor services, outpatient care, medical supplies, and preventive services

Original Medicare does not cover most prescription drugs or other services private insurers may offer.

MEDICARE SUPPLEMENT (MEDIGAP)A Medicare Supplement (Medigap) policy is an additional option when purchasing Original Medicare. It’s sold by private insurers and helps pay some or all the health care costs that Medicare doesn’t cover, like copayments. coinsurance. deductibles.

MEDICARE ADVANTAGE PART C PLANSThis type of plan is administered by a private health insurer. These plans, in addition to offering everything Original Medicare provides, offer additional features and benefits that you may not get with a Medicare Supplement plan.Most of these plans include prescription drug coverage and have in-network doctors. You would pay your premium directly to a private insurer and maintain lower out of pocket costs if seeing network doctors.

When selecting a Medicare Advantage Plan you would still be required to pay your Medicare Part B premium, normally deducted from your social security check.

MEDICARE PART D (PRESCRIPTION DRUG COVERAGE)This type of plan is administered by a private health insurer. Medicare Part D is a standalone prescription plan that helps cover your prescription needs and is typically paired with a Medicare Supplement plan. Many Medicare Advantage plans have Part D drug coverage, but there are some that offer medical benefits only. You are not allowed to have both a Medicare Advantage plan and a stand-alone Part D drug plan.

Oct 8, 2018

5 Ways Medicare Will Improve in 2019

Changes range from an early close of the donut hole to expanded Medicare Advantage plan benefits.

Now 53 years old, Medicare has higher rates of satisfaction from its 60 million members than almost any other form of health insurance. It is about to get better. Here are seven improvements to Medicare that will take effect in 2019. Some of the changes will affect all beneficiaries while others will apply just to individuals who select Medicare Advantage plans.

Donut hole for Prescription Rx

An expensive element of the Medicare Part D prescription drug benefit requires enrollees with high prescription costs to pay more for their medicines after they reach a certain level of spending in one year. This creates a coverage gap – also called the “donut hole.” After a beneficiary’s out-of-pocket spending reaches a second threshold, they enter catastrophic coverage and pay substantially less. Under the Affordable Care Act (ACA), the donut hole was scheduled to close in 2020. But the spending bill Congress passed in March will close the donut hole for some certain brand-name drugs in 2019. The gap will close for generic drugs in 2020.

Therapy cap gone

Beneficiaries of original Medicare won’t have to pay the full cost of outpatient Physical, Speech or Occupational therapy because Congress permanently repealed the cap that has historically limited coverage of those services.

Lifestyle support.

Beginning in January, Medicare Advantage plans have the option to cover meals delivered to the home, transportation to the doctor’s office and even safety features in the home such as bathroom grab bars and wheelchair ramps. To be covered, a medical provider will have to recommend benefits such as home-safety improvements and prepared meals.

In-home help

Medicare Advantage plans also will have the option to pay for assistance from home health aides, who can help beneficiaries with their daily activities including dressing, eating and personal care. These benefits represent a revised and broader definition of the traditional requirement that Medicare services must be primarily health related.

Test Drive your Advantage Plan

Open Enrollment January thru March 2019

__________________________________________________________________________________________________________

To enroll in Medicare 2019, fill our our Medicare Enrollment form and complete the information.

__________________________________________________________________________________________________________

New regulations will let people try an Advantage plan for up to three months and, if they aren’t satisfied, they can switch to another Medicare Advantage plan or choose to enroll in original Medicare. Congress required this flexibility in the 21st Century Cures Act, designed to accelerate innovation in health care.

5 Ways Medicare Will Improve in 2019

Changes range from an early close of the donut hole to expanded Medicare Advantage plan benefits.

Now 53 years old, Medicare has higher rates of satisfaction from its 60 million members than almost any other form of health insurance. It is about to get better. Here are seven improvements to Medicare that will take effect in 2019. Some of the changes will affect all beneficiaries while others will apply just to individuals who select Medicare Advantage plans.

Donut hole for Prescription Rx

An expensive element of the Medicare Part D prescription drug benefit requires enrollees with high prescription costs to pay more for their medicines after they reach a certain level of spending in one year. This creates a coverage gap – also called the “donut hole.” After a beneficiary’s out-of-pocket spending reaches a second threshold, they enter catastrophic coverage and pay substantially less. Under the Affordable Care Act (ACA), the donut hole was scheduled to close in 2020. But the spending bill Congress passed in March will close the donut hole for some certain brand-name drugs in 2019. The gap will close for generic drugs in 2020.

Therapy cap gone

Beneficiaries of original Medicare won’t have to pay the full cost of outpatient Physical, Speech or Occupational therapy because Congress permanently repealed the cap that has historically limited coverage of those services.

Lifestyle support.

Beginning in January, Medicare Advantage plans have the option to cover meals delivered to the home, transportation to the doctor’s office and even safety features in the home such as bathroom grab bars and wheelchair ramps. To be covered, a medical provider will have to recommend benefits such as home-safety improvements and prepared meals.

In-home help

Medicare Advantage plans also will have the option to pay for assistance from home health aides, who can help beneficiaries with their daily activities including dressing, eating and personal care. These benefits represent a revised and broader definition of the traditional requirement that Medicare services must be primarily health related.

Test Drive your Advantage Plan

Open Enrollment January thru March 2019

__________________________________________________________________________________________________________

To enroll in Medicare 2019, fill our our Medicare Enrollment form and complete the information.

__________________________________________________________________________________________________________

New regulations will let people try an Advantage plan for up to three months and, if they aren’t satisfied, they can switch to another Medicare Advantage plan or choose to enroll in original Medicare. Congress required this flexibility in the 21st Century Cures Act, designed to accelerate innovation in health care.

September 15, 2018

It’s National Medicare Education Week: Get Ready for Medicare Annual Enrollment with These Online Resources

Medicare’s Annual Enrollment Period is almost here — the time (Oct. 15 to Dec. 7) when people can make changes to their medicare coverage for the year ahead.

Thankfully, there are tools and resources to help you navigate the process and select a plan to meet your needs. National Medicare Education Week begins Sept.15 with one goal: to help empower people to make informed choices about their Medicare coverage. Local education events are planned across the country and online to help you prepare for the fall Annual Enrollment Period. You can check out a list of events in your area here.

Thankfully, there are tools and resources to help you navigate the process and select a plan to meet your needs. National Medicare Education Week begins Sept.15 with one goal: to help empower people to make informed choices about their Medicare coverage. Local education events are planned across the country and online to help you prepare for the fall Annual Enrollment Period. You can check out a list of events in your area here.

September 6, 2018

New Open Enrollment Period for Medicare Advantage

Want to switch to a different Medicare Advantage plan? Starting in 2019, you’ll have a new opportunity to do so. You’ll have more time to enroll (or disenroll). We’ve captured the details of the Medicare Advantage open enrollment changes below.

- Switch to a different Medicare Advantage plan

- Drop your Medicare Advantage plan and return to Original Medicare, Part A and Part B

- Sign up for a stand-alone Medicare Part D Prescription Drug Plan (if you return to Original Medicare). Most Medicare Advantage plans include prescription drug coverage already. Usually you can’t enroll in a stand-alone Medicare Prescription Drug plan if you already have a Medicare Advantage plan, but there are some situations where you can. Call your Medicare Advantage plan if you have questions.

- Drop your stand-alone Medicare Part D Prescription Drug Plan

July 4, 2018

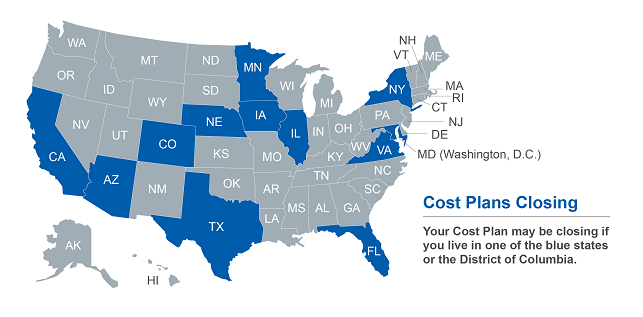

If You Have a Medicare Cost Plan, It Could Be Your Year to Shop

Fall is Medicare plan shopping season. The Annual Enrollment Period starts on October 15 and runs through December 7.

It’s a good idea to review your Medicare coverage every year – and change it if needed. This year, it’s not only wise, it may be necessary.

It’s a good idea to review your Medicare coverage every year – and change it if needed. This year, it’s not only wise, it may be necessary.

April 22, 2018

5 Reasons Men Skip Doctor Visits, and Shouldn’t

Men are 24 percent less likely than women to have visited a doctor within the past year, according to the Agency for Healthcare Research and Quality (AHRQ). The graphic below, created at Georgetown University, shows more shocking statistics. For example:

- 7 million American men have not seen a doctor in more than 10 years.

- Two-thirds of men would not seek a health care professional if they were experiencing chest pain or shortness of breath, two early warning signs of a heart attack.

- And, surprisingly, more than half of all premature deaths among men are preventable.

April 2, 2018

Your Pharmacist is a Valuable Medicare Resource

As part of National Medicare Education Week, we asked leaders from organizations and companies in the health and aging fields about preparing for Medicare Annual Enrollment, which runs from Oct. 15 to Dec. 7. This is the time each year when you can change your coverage choices for the following year. Today we focus on Medicare Part D prescription drug coverage and the help that you might find at your local pharmacy.

March 20, 2018

Understanding the four basic parts of Medicare

Part A, Part B, Part C – learning about Medicare can feel like looking into a bowl of alphabet soup. But to get the coverage that’s best for you, it’s important to know your choices. And that starts with understanding Medicare’s four basic parts.

Here’s a quick and simple review of the parts of Medicare and what each covers.

Once you have the Medicare ABCs down, you can learn how the parts work together so you can get the coverage you need.

Here’s a quick and simple review of the parts of Medicare and what each covers.

Once you have the Medicare ABCs down, you can learn how the parts work together so you can get the coverage you need.

October 17, 2017

ANNOUNCING....TROUT ON MAIN

After all these years on the road - We now have an actual storefront! Located in the heart of downtown Weaverville - 29 N. Main Street. Jan Trout has done a wonderful job putting this project together.

For the story behind our big move - see Trout Insurance on Main Street. |

Visit our Medicare & Health Insurance Enrollment Center

Why drive to south Asheville and fight the traffic when you can come to beautiful Weaverville and visit our Medicare & Health Insurance Enrollment Center. Annual Enrollment for Medicare is open. We have companies with Mission Health as In-Network

April 30, 2017

Did You Get Your Original Medicare Card?

Have you recently enrolled in Medicare? If so, you’re probably wondering when you’re original Medicare card will arrive. There are a few factors to consider.

You will be enrolled and receive your member card automatically if you meet one of the following conditions.

To enroll in Original Medicare, apply online at Social Security or call 1-800-772-1213; TTY 1-800-325-0778 (7 a.m. – 7 p.m., local time, Monday – Friday.

Determining Medicare coverage can be complicated. To learn more about Original Medicare, your qualifications, and other coverage available, contact Trout Insurance to talk to one of our independent agents who can walk you through the process today.

Did You Get Your Original Medicare Card?

Have you recently enrolled in Medicare? If so, you’re probably wondering when you’re original Medicare card will arrive. There are a few factors to consider.

You will be enrolled and receive your member card automatically if you meet one of the following conditions.

- If you’ve turned 65 and are receiving Social Security Insurance or Railroad Retirement Board benefits, your Medicare card should arrive before your coverage begins on the first day of your birthday month. Note that if your birthday is on the first day of the month, coverage may start the month prior.

- If you’re younger than 65 but have received social security disability benefits for 24 months, your Medicare card should arrive during the 25th month of receiving disability benefits. Coverage starts at the beginning of the 25th month.

- If you have Lou Gehrig’s disease (Amyotrophic Lateral Sclerosis/ALS) and begin receiving social security disability benefits, you should receive your Medicare card the first month your disability begins. Coverage will also start the first month your disability benefits begin.

- If you are about to turn 65 and are not receiving Social Security Insurance or Railroad Retirement Board benefits, you will receive your member card after you complete your Original Medicare enrollment. Coverage typically begins the first day of your birthday month, or the prior month if your birthday is on the first day of the month.

- If you have End-Stage Renal Disease or permanent kidney failure requiring dialysis or a kidney transplant, you will receive your member card once you complete your Original Medicare enrollment. Coverage starts the first month your disability begins.

- If you need to replace a lost or damaged Medicare card, you can request one online. Your card should arrive in the mail in about 30 days.

To enroll in Original Medicare, apply online at Social Security or call 1-800-772-1213; TTY 1-800-325-0778 (7 a.m. – 7 p.m., local time, Monday – Friday.

Determining Medicare coverage can be complicated. To learn more about Original Medicare, your qualifications, and other coverage available, contact Trout Insurance to talk to one of our independent agents who can walk you through the process today.

March 23, 2017

Does Medicare Cover That? Physical Exams, Wellness Visits, and More

Do you try to make it to the doctor every year for your annual physical? Do you think of this visit as a head-to-toe assessment of your health? Well, your definition and that of the medical community may be different.

The National Institutes of Health (NIH) defines a physical exam as an overall examination of body to determine if there are physical properties. NIH suggests it includes:

So what does Medicare cover?

Welcome to Medicare Visit

Medicare Part B covers what is called a Welcome to Medicare Visit.

It is also sometimes referred to as an Initial Preventive Physical Exam or IPPE. You are eligible for this benefit once within the first 12 months after your enrollment. In this visit, your care provider will:

After the visit, your provider will give you a personalized prevention plan or checklist with the screenings and preventive services they recommend. These services are not part of the Welcome Visit and you may have to pay a co-payment when you get them. Your Part B deductible may also apply.

Medicare Wellness Visit

Medicare Part B also covers an annual Wellness Visit. You are eligible for this benefit once each year, after you’ve been enrolled in Part B for at least 12 months. Medicare will cover an Annual Wellness Visit once every 12 months.

Here you will update your overall healthcare plan. The visit includes an assessment on your health risks, review of your medical history, and updating your list of doctors and medications. They will document your routine measurements, such as weight or blood pressure. They may also look for signs of memory loss or dementia. They can provide personalized health advice, a list of risk factors and treatments options, and a screening schedule for additional preventative services they recommend.

What Happens Next?

Before you can take advantage of any of these services, you need to enroll in a Medicare plan that is right for you. To get the best possible coverage, contact a professional independent agent to help you through the process. Trout Insurance is here to help, so call today.

Does Medicare Cover That? Physical Exams, Wellness Visits, and More

Do you try to make it to the doctor every year for your annual physical? Do you think of this visit as a head-to-toe assessment of your health? Well, your definition and that of the medical community may be different.

The National Institutes of Health (NIH) defines a physical exam as an overall examination of body to determine if there are physical properties. NIH suggests it includes:

- Inspecting the body visually

- Feeling the body

- Listening to the sounds of the body

- Tapping on the body to produce percussive sounds

So what does Medicare cover?

Welcome to Medicare Visit

Medicare Part B covers what is called a Welcome to Medicare Visit.

It is also sometimes referred to as an Initial Preventive Physical Exam or IPPE. You are eligible for this benefit once within the first 12 months after your enrollment. In this visit, your care provider will:

- Record and evaluate your medical and family history, current health conditions and prescriptions.

- Check your blood pressure, vision, weight and height to get a baseline for your care.

- Make sure you are up-to-date with preventive screenings and services, such as cancer screenings and immunizations.

- Order further tests, depending on your general health and medical history.

After the visit, your provider will give you a personalized prevention plan or checklist with the screenings and preventive services they recommend. These services are not part of the Welcome Visit and you may have to pay a co-payment when you get them. Your Part B deductible may also apply.

Medicare Wellness Visit

Medicare Part B also covers an annual Wellness Visit. You are eligible for this benefit once each year, after you’ve been enrolled in Part B for at least 12 months. Medicare will cover an Annual Wellness Visit once every 12 months.

Here you will update your overall healthcare plan. The visit includes an assessment on your health risks, review of your medical history, and updating your list of doctors and medications. They will document your routine measurements, such as weight or blood pressure. They may also look for signs of memory loss or dementia. They can provide personalized health advice, a list of risk factors and treatments options, and a screening schedule for additional preventative services they recommend.

What Happens Next?

Before you can take advantage of any of these services, you need to enroll in a Medicare plan that is right for you. To get the best possible coverage, contact a professional independent agent to help you through the process. Trout Insurance is here to help, so call today.

January 15, 2017

Medicare Shopping Tips to Make Your Life Easier

Are you already a savvy shopper? Do you like to clip coupons, use your senior discount, and buy in bulk to reduce your expenses? If so, you’re the kind of person who wants to extend your thrifty spending to your Medicare coverage. You can save money and remain covered at the same time, and here are some tips to make that happen.

1. Take Advantage of Preventative Care Benefits

Medicare covers many preventive screenings, like mammograms and colonoscopies, often at no additional cost. When you catch major problems early, they’ll be easier to treat. Talk with your doctor about the options.

Some additional services may also be covered under some Medicare Advantage Plans (also known as Part C) in additional to those covered by Original Medicare (Parts A and B). Dental, hearing, vision, and more may be covered.

2. Make a Yearly Healthcare Budget

While the costs will vary greatly depending on your coverage, planning ahead can help you save.

For example, Medicare Part B covers about 80% of the cost of most medical services like doctor visits and lab tests. With this coverage, you are responsible for the other 20%. You can buy a Medicare supplement insurance plan to help cover these additional costs.

Knowing the annual out-of-pocket cap on health care costs with these plans could provide peace of mind in the event of an unexpected illness when scheduling a major medical procedure.

3. Save with Drug Benefits

Prescription drugs are often the biggest sticking point for people using Medicare insurance programs. They simply aren’t covered by Original Medicare. There are a couple of ways to ensure that your medications are covered, but it helps to talk with a professional who understands the insurance process.

For example, some plans offer home delivery which can save money and reduce your trips to the pharmacy. Others may have a preferred pharmacy network that offers lower copays. Or you may even be able to use generic or other low-cost alternatives based on your medical needs and advice from your doctor.

4. Work With your Network Providers

Medicare Advantage plans work with a network of providers, including doctors and hospitals. Plans contract with network providers to provide care to plan members at negotiated prices. This allows for lower out-of-pocket costs for plan members.

What Should You Do Now?

There are also a number of other potential discounts you can get when you shop for the right plan. The process can be complicated to try on your own, but you don’t have to. Contact the team of independent agents at Trout Insurance to discuss the best options for you.

Medicare Shopping Tips to Make Your Life Easier

Are you already a savvy shopper? Do you like to clip coupons, use your senior discount, and buy in bulk to reduce your expenses? If so, you’re the kind of person who wants to extend your thrifty spending to your Medicare coverage. You can save money and remain covered at the same time, and here are some tips to make that happen.

1. Take Advantage of Preventative Care Benefits

Medicare covers many preventive screenings, like mammograms and colonoscopies, often at no additional cost. When you catch major problems early, they’ll be easier to treat. Talk with your doctor about the options.

Some additional services may also be covered under some Medicare Advantage Plans (also known as Part C) in additional to those covered by Original Medicare (Parts A and B). Dental, hearing, vision, and more may be covered.

2. Make a Yearly Healthcare Budget

While the costs will vary greatly depending on your coverage, planning ahead can help you save.

For example, Medicare Part B covers about 80% of the cost of most medical services like doctor visits and lab tests. With this coverage, you are responsible for the other 20%. You can buy a Medicare supplement insurance plan to help cover these additional costs.

Knowing the annual out-of-pocket cap on health care costs with these plans could provide peace of mind in the event of an unexpected illness when scheduling a major medical procedure.

3. Save with Drug Benefits

Prescription drugs are often the biggest sticking point for people using Medicare insurance programs. They simply aren’t covered by Original Medicare. There are a couple of ways to ensure that your medications are covered, but it helps to talk with a professional who understands the insurance process.

For example, some plans offer home delivery which can save money and reduce your trips to the pharmacy. Others may have a preferred pharmacy network that offers lower copays. Or you may even be able to use generic or other low-cost alternatives based on your medical needs and advice from your doctor.

4. Work With your Network Providers

Medicare Advantage plans work with a network of providers, including doctors and hospitals. Plans contract with network providers to provide care to plan members at negotiated prices. This allows for lower out-of-pocket costs for plan members.

What Should You Do Now?

There are also a number of other potential discounts you can get when you shop for the right plan. The process can be complicated to try on your own, but you don’t have to. Contact the team of independent agents at Trout Insurance to discuss the best options for you.

November 10, 2016

CMS releases Medicare Parts A, B premiums,deductibles

Annual deductible for all Medicare Part B beneficiaries will be $183 in 2017, compared to $166 in 2016....(read more)

CMS releases Medicare Parts A, B premiums,deductibles

Annual deductible for all Medicare Part B beneficiaries will be $183 in 2017, compared to $166 in 2016....(read more)

October 7, 2016

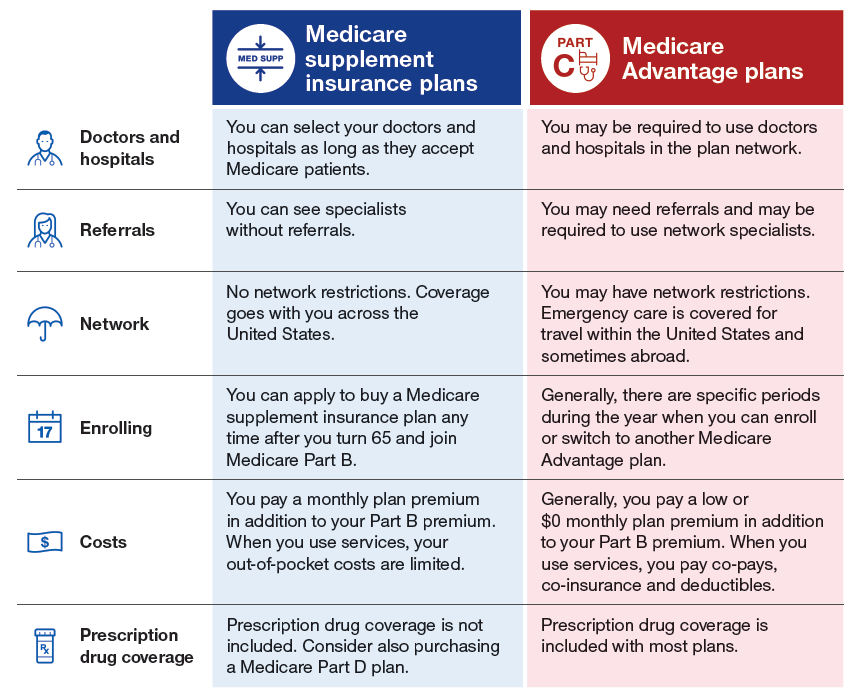

Medicare Supplement vs. Medicare Advantage

Medicare supplement insurance, or Medigap, is coverage that you can add to Original Medicare Parts A and B. Medicare Advantage (Part C) is an alternative to Original Medicare Parts A and B. It’s a different way to get your Medicare benefits.

Both Medicare supplement insurance plans and Medicare Advantage plans are offered by private insurance companies approved by Medicare. With either choice, you continue to pay a monthly Part B premium to Medicare. The main things to think about when deciding between them are:

Medicare Supplement vs. Medicare Advantage

Medicare supplement insurance, or Medigap, is coverage that you can add to Original Medicare Parts A and B. Medicare Advantage (Part C) is an alternative to Original Medicare Parts A and B. It’s a different way to get your Medicare benefits.

Both Medicare supplement insurance plans and Medicare Advantage plans are offered by private insurance companies approved by Medicare. With either choice, you continue to pay a monthly Part B premium to Medicare. The main things to think about when deciding between them are:

- Do you want the choice of any provider or are you willing to choose a provider from within a provider network?

- Would you rather buy a separate prescription drug plan or get drug coverage included in one plan?

- Would you rather pay more in monthly premiums and have lower out-of-pocket costs for services you receive or pay a low or $0 monthly premium and co-pays for services as you use them?

September 13, 2016

AEP is coming - That’s the Annual Enrollment Period for folks on Medicare. Starting October 15 and ending December 7, during these dates, Medicare beneficiaries may look at several options in their insurance coverage.

If you have a current Advantage plan, you may change plans and companies; shopping for the best value. Or if you have a Medicare Supplement plan, you may consider these options.

AEP is coming - That’s the Annual Enrollment Period for folks on Medicare. Starting October 15 and ending December 7, during these dates, Medicare beneficiaries may look at several options in their insurance coverage.

- Prescription Coverage - Medicare Part D - you may choose a new plan which may fit your needs better than the one you currently have. Remember, the insurance companies negotiate directly with the RX manufactures on how much they and you will pay for medication. And they use networks for pharmacies as well.

- Even if you are happy with your RX plan – it is always best to shop to get the best value.

- Medicare Advantage Plans – these provide coverage equivalent or better than original Medicare. Most have copays for doctors & specialist visits, a daily rate for hospital and copay or percentage for outpatient. Many plans include prescription coverage.

If you have a current Advantage plan, you may change plans and companies; shopping for the best value. Or if you have a Medicare Supplement plan, you may consider these options.

|

|

|

Source: MedicareMadeClear.com